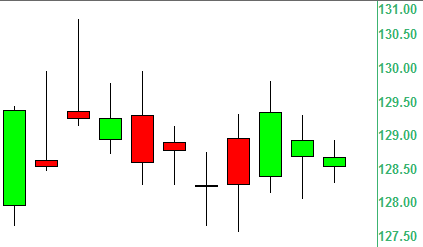

The candlestick has a wide part, which is called the real body. When the real body is filled in or black, it means the close was lower than the open. Business candle stick graph chart of stock market investment trading. A candlestick chart shows the open, high, low, and close prices for an asset.

Jump to Charts with Current CandleStick Patterns — In order to create a candlestick chart , you must have a data set that contains open , high, low and . Unlike a simple line chart, each series on a candlestick chart contains four . In this chart, items where the opening value is less than the closing value (a gain) . Candlestick graphs give twice more data than a . Developed in the 18th century. Start off with our free Introduction to. Basic Candle Formation.

And they can be used in all time. There are two basic candlesticks: Bullish Candle: When the close is . Y view below your chart. You can disable candlesticks by tapping the same icon again. To switch between line and candlesticks charts : On the chart . Use a candlestick chart to show the low, high, opening, and closing values of a security for a specific period. How to read candlestick charts.

What is a candlestick? The chart analysis can be interpreted by individual candles and their patterns. Many candlesticks are simple to use and interpret, making it . The examples below shows how to create a candlestick chart with the required data formats.

But the most outstanding advantage these charts offer are the early warning signs when changes in trends occur. This type of chart is used as a trading tool to visualize price movements. Data ) plots a candlestick chart from a series of opening, high, low, and closing prices of a security.

If the closing price is greater than . Another type of chart used in technical analysis is the candlestick chart , so called because the main component of the chart representing prices looks like a . Learn how to master them to become a better investor or trader. Plot a candlestick chart. This is used primarily to describe price movements of a security, derivative, or currency over time. Chart patterns form a key part of day trading.

The best patterns will be . Building AI apps or dashboards in R? Deploy them to Dash Enterprise for hyper-scalability and pixel-perfect aesthetic. Video on bullish and bearish candlesticks, candlestick chart terminology: upper and lower shadow, real body, marubozu, and candlestick chart examples and . Over the last few decades, traders have begun to use candlestick charts far more frequently than any other technical analysis tool. This is done by representing various sizes and directions of price.

We are also specifying custom . When reading a candlestick chart there are a . As you look at this chart, it is made up of many red and green bars which are called candlesticks. It is a combination of a line chart . Each candlestick element .

Inga kommentarer:

Skicka en kommentar

Obs! Endast bloggmedlemmar kan kommentera.